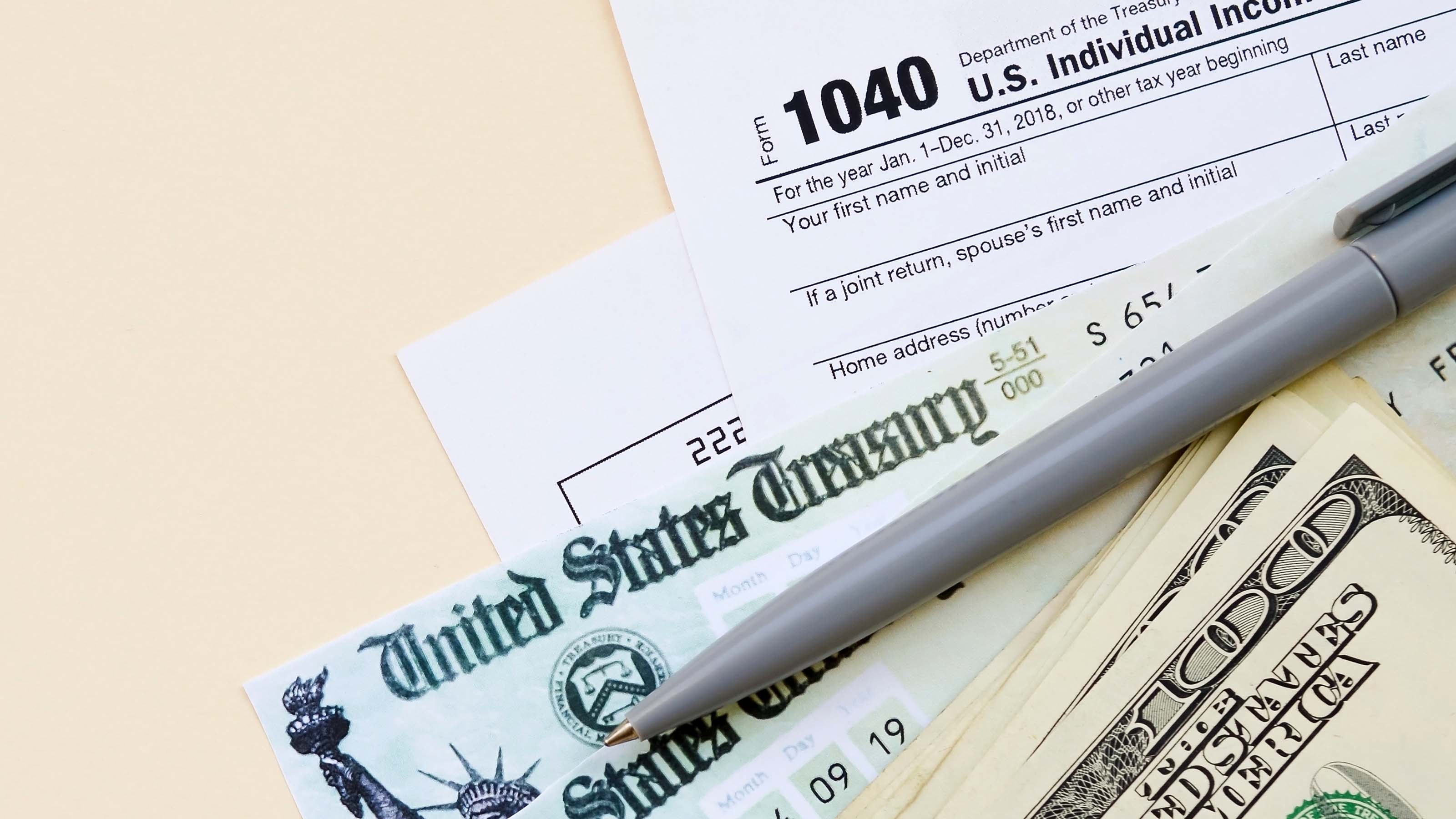

It’s a day likely on the minds of many, and one that can bring anxiety: This year’s federal tax filing deadline lands on Monday, April 18.

Leading up to it, taxpayers are seeing scores of advertisements promising “free tax-filing” services.

Is there such a thing? Chicagoans are asking this precise question.

It is also at the heart of a lawsuit now playing out in a San Francisco district courtroom.

The Federal Trade Commission recently filed a lawsuit against one of the largest and most popular tax preparers in the country: Intuit, the parent company of TurboTax.

In commercial after commercial - featuring barking auctioneers and pumped-up exercise instructors – the FTC alleges Intuit is “engaging in deceptive acts” by stating its services are free when “in numerous instances [Intuit] does not permit consumers to file their taxes for free using TurboTax.”

After taxpayers invest their time and share personal and financial information with the company, “Intuit tells them… they cannot continue for free; they will need to upgrade to a paid service to complete and file their taxes,” according to the FTC’s civil complaint.

Regulators went as far as asking a judge for a temporary restraining order on the company’s advertising while the case proceeds in court. A hearing on that issue is scheduled for April 21 – three days after the tax deadline.

In a prepared statement, Intuit said the company will “vigorously challenge” the complaint, saying that “the FTC’s arguments are simply not credible.”

Intuit said in the last eight years, the tax giant has “helped nearly 100 million Americans file their taxes for free.”

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter.

IRS Free File Program

That word "free" is at the heart of an increasingly common question that many consumers across the Chicago area are asking as they begin to prepare their taxes. Google trends show hundreds of local searches on that very question, every day.

One surprising source – the Internal Revenue Service itself – said the answer is yes, many can find a way to file for free.

“If you made less than $73,000, you're probably eligible to use ‘Free File,” IRS spokesperson Michael Devine told NBC 5 Responds.

The IRS estimates 70% of taxpayers are eligible to use its “Free File” program here, which has been around for nearly two decades.

If this is the first you’re learning about it, you’re not alone. The “Free File” option has recently faced some scrutiny because so few taxpayers are aware of it.

An audit by the Treasury Inspector General found in 2019, only 2% of those eligible for the free program used it. And worse, the audit found millions of those eligible to file for free ended up paying a commercial tax filing service.

The audit blamed that on “the complexity, confusion, and lack of taxpayer awareness about the… Free File program.”

Volunteer Income Tax Assistance or VITA Sites

There are more free options out there if you know where to look, and to whom to turn.

“There's a free option for just about everybody,” Devine said. “If you make less than $58,000, you can go to a volunteer site.”

Volunteer Income Tax Assistance or VITA sites are all across the Chicago area, including one of the largest sites on the seventh floor of the Harold Washington Library.

There, you will find volunteers from the organization Ladder Up, providing tax assistance to anyone who makes less than $58,000 a year.

And it’s totally free.

As of April 3, Ladder Up told NBC 5 Responds it has processed more than 8,500 tax returns, totaling more than $17.3 million in refunds to local taxpayers.

This year alone, accountants, lawyers and students have contributed more than 18,000 volunteer hours of tax help, all wanting to give back.

“We actually want to reach more people,” said Phyllis Cavallone-Jurek, executive director of Ladder Up. “We don't want to turn anybody away that thinks that they're eligible and would like to get our services. We want to grow and serve as many people as possible.”

Ladder Up’s Chief Operating Officer Hedi Belkaoui said volunteers understand the topic of tax filing can often be tense, and that’s why they want to get the word out about their free services.

"Taxes make people scared,” said Belkaoui. “For me, this is what we should be doing. This is just what should happen for these folks. And not just for certain people that can afford a paid preparer.”

To find a VITA center near you, click here.

Red Flags and Other Free Services

Looking for free tax filing services can be tricky terrain. Here are some red flags you can look out for:

- No service or tax preparer should base their fees on the amount of your return, according to the IRS.

- If a service claims they can file your taxes for free, make sure your tax situation does not require any upgrades. Often times, services will say free services are only available for ‘simple returns’

- Be on the lookout for tax services offering upgrades that cost extra

For more red flags and a checklist from the IRS on things to look out for when picking a tax filing provider, click here.

The IRS said in 2022, the following service providers are participating in its “Free File” program:

- 1040Now.NET

- ezTaxReturn.com (available in Spanish)

- FreeTaxReturn.com INC

- FileYourTaxes.com

- On-Line Taxes at OLT.com

- TaxAct

- FreeTaxUSA ®

- TaxSlayer (coming soon in Spanish)

Another free tax resource available for the military community is MilTax – offered through the Department of Defense.