A shopper passes by a jewelry store that is going out of business in Brooklyn, New York, U.S., December 8, 2020.

For nearly 100 years, since the stock market crash of 1929 kicked off the decade-long Great Depression, Americans have been conditioned to think of a falling market as a sign that the economy was in peril — and that surging stocks meant a thriving economy that was better for all.

Now, with an historic disconnect between the fortunes of Wall Street and Main Street as a result of the COVID-19 pandemic, a new survey is showing a growing shift in America's attitude toward the market as well.

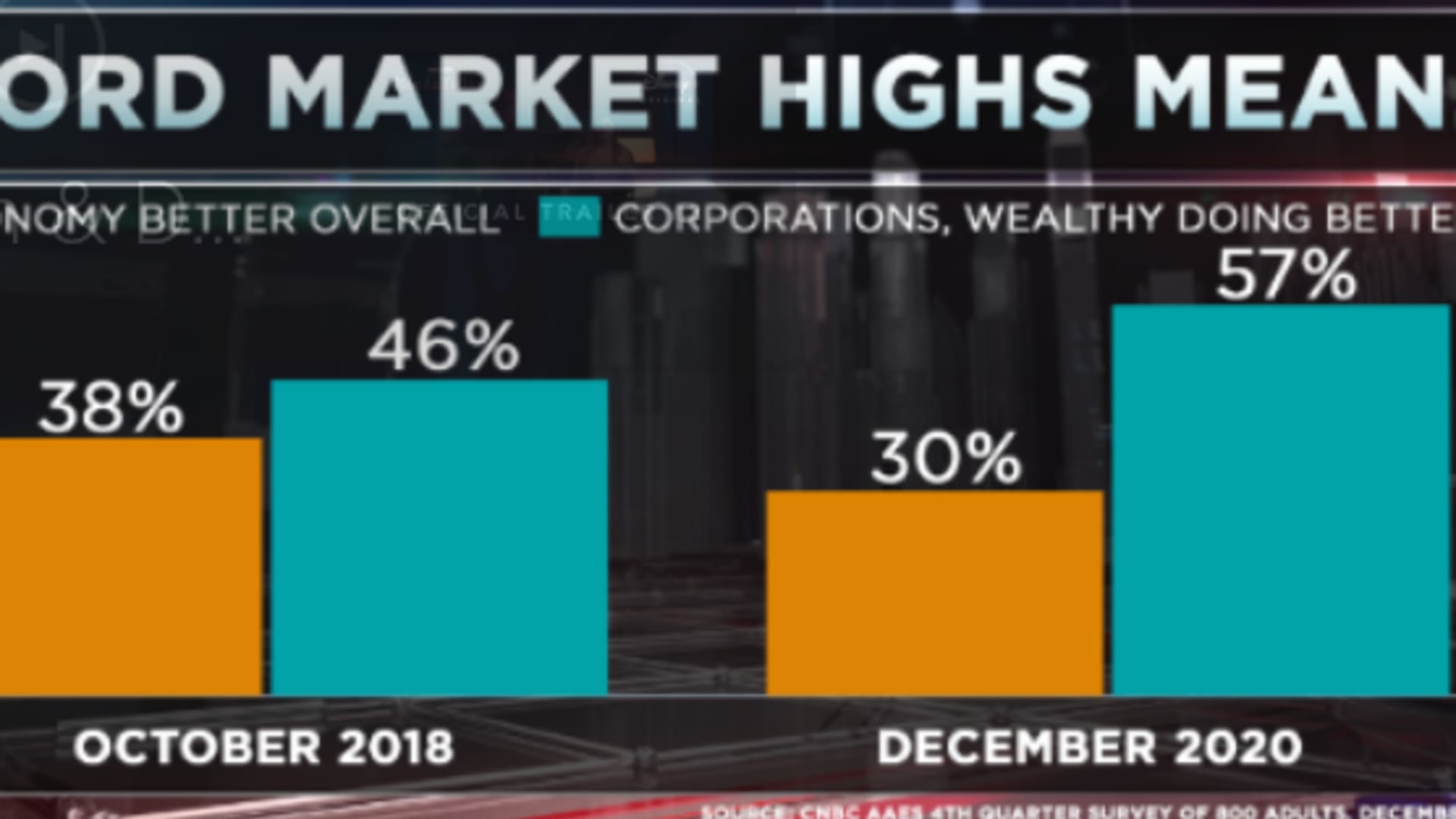

According to the CNBC All-America Economic survey, 57% of respondents said that new highs in the Dow, S&P 500 and the Nasdaq meant that corporations and the wealthy were doing better, while only 30% said that a record-breaking market meant the overall economy was doing better.

This represents a marked change from the last time the question was asked in October 2018, a year that boasted both fresh market highs and new record lows in unemployment. Back then, 38% of respondents said equities on the rise meant a robust economy overall, and 46% said benefits primarily went to big business and the rich.

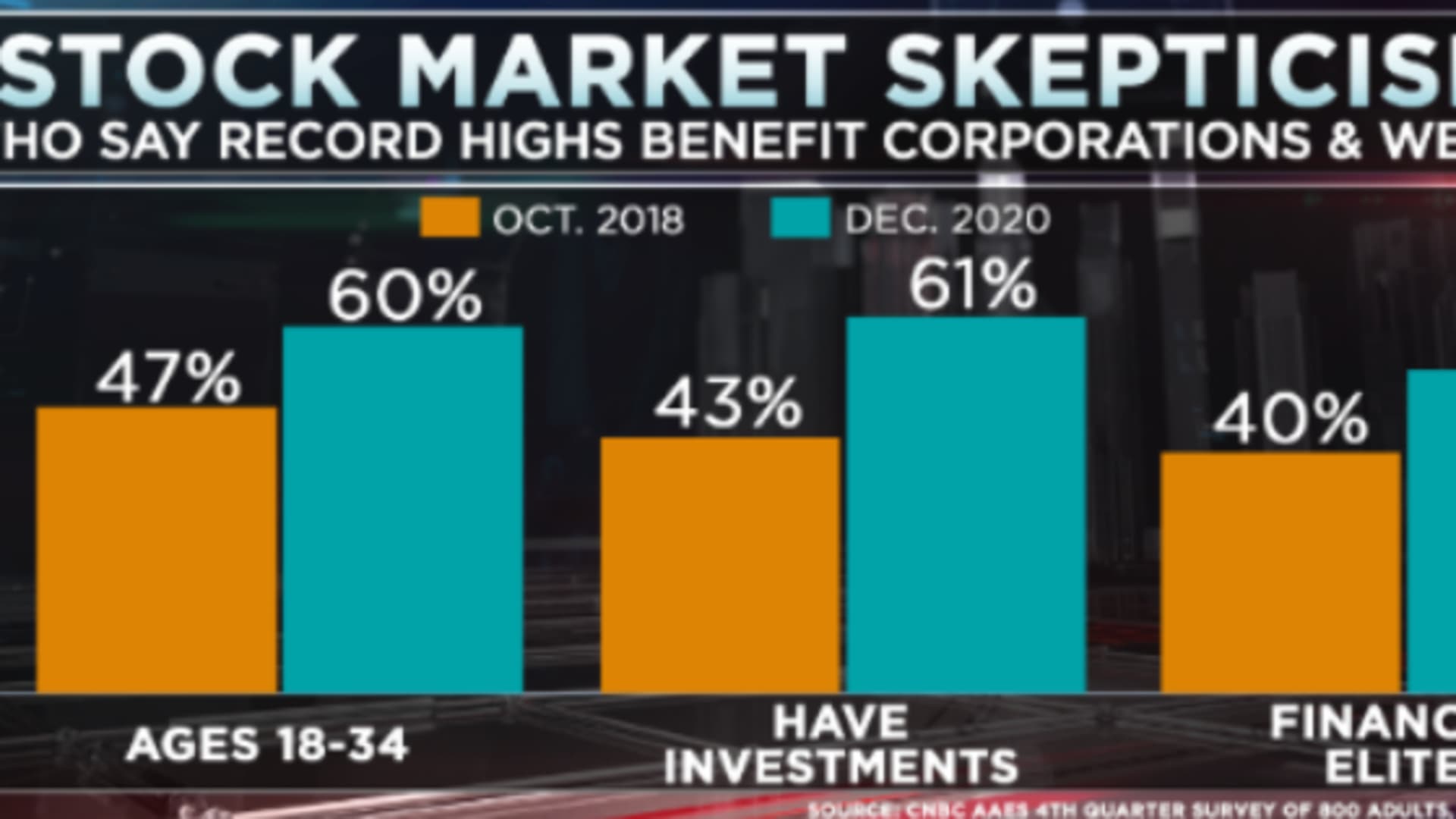

The change in attitudes was represented across nearly all demographics – and all levels of exposure to the market. Sixty percent of young adults ages 18-34, among the least likely to have money in the stock market, said market gains mostly benefitted corporations and the wealthy. However, that number rose to 61% among all adults who reported having investments.

Even among financial elites, those with $50,000 or more in investments and an annual household income of $75,000 or greater, 53% of respondents said market gains mostly went to large businesses and the top 1%.

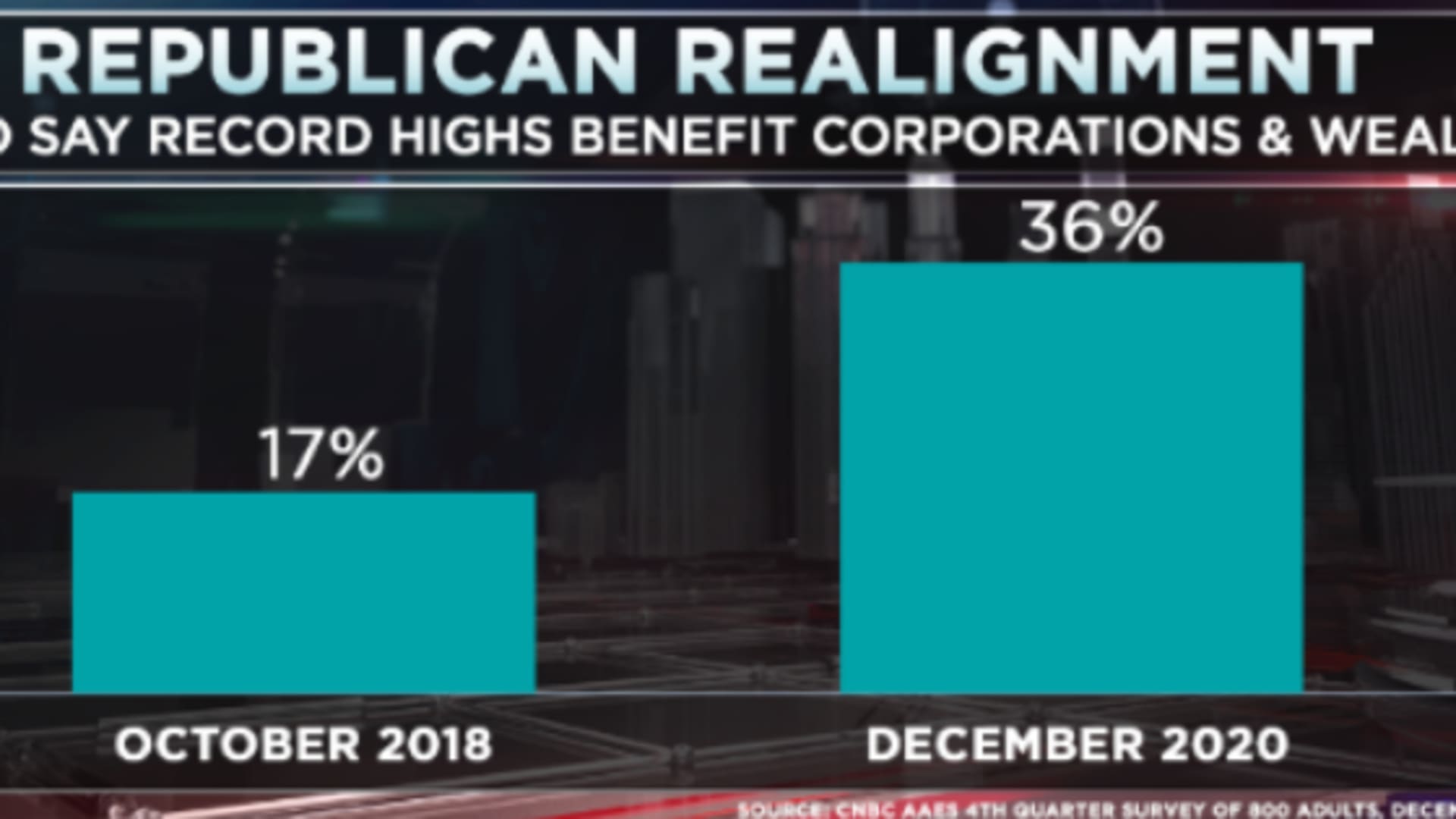

The survey showed an notable shift among Republicans – long among the most likely to say the economy benefits from a strong market. In October 2018, just 17% said that higher stocks helped the wealthy and corporations. In December of 2020, 36% agreed with that statement – a rise of nearly 20 percentage points.