- If you're in the 0% long-term capital gains bracket, you can reduce future taxes with a lesser-known strategy, tax-gain harvesting, experts say.

- For 2024, you qualify for the 0% rate with taxable income of $47,025 or less for single filers and $94,050 or less for married couples filing jointly.

- You can use the 0% bracket to reset your "basis," or original purchase price of cryptocurrency, to save on taxes.

Crypto investors could face higher taxes amid the surging price of bitcoin. But if you're in the 0% capital gains bracket, you can reduce future taxes with a lesser-known strategy, experts say.

The tactic, known as tax-gain harvesting, is selling profitable crypto in a lower-income year. You can leverage the 0% long-term capital gains rate — meaning you won't owe taxes on gains — as long as earnings are below a certain threshold. The 0% bracket applies to assets owned for more than one year.

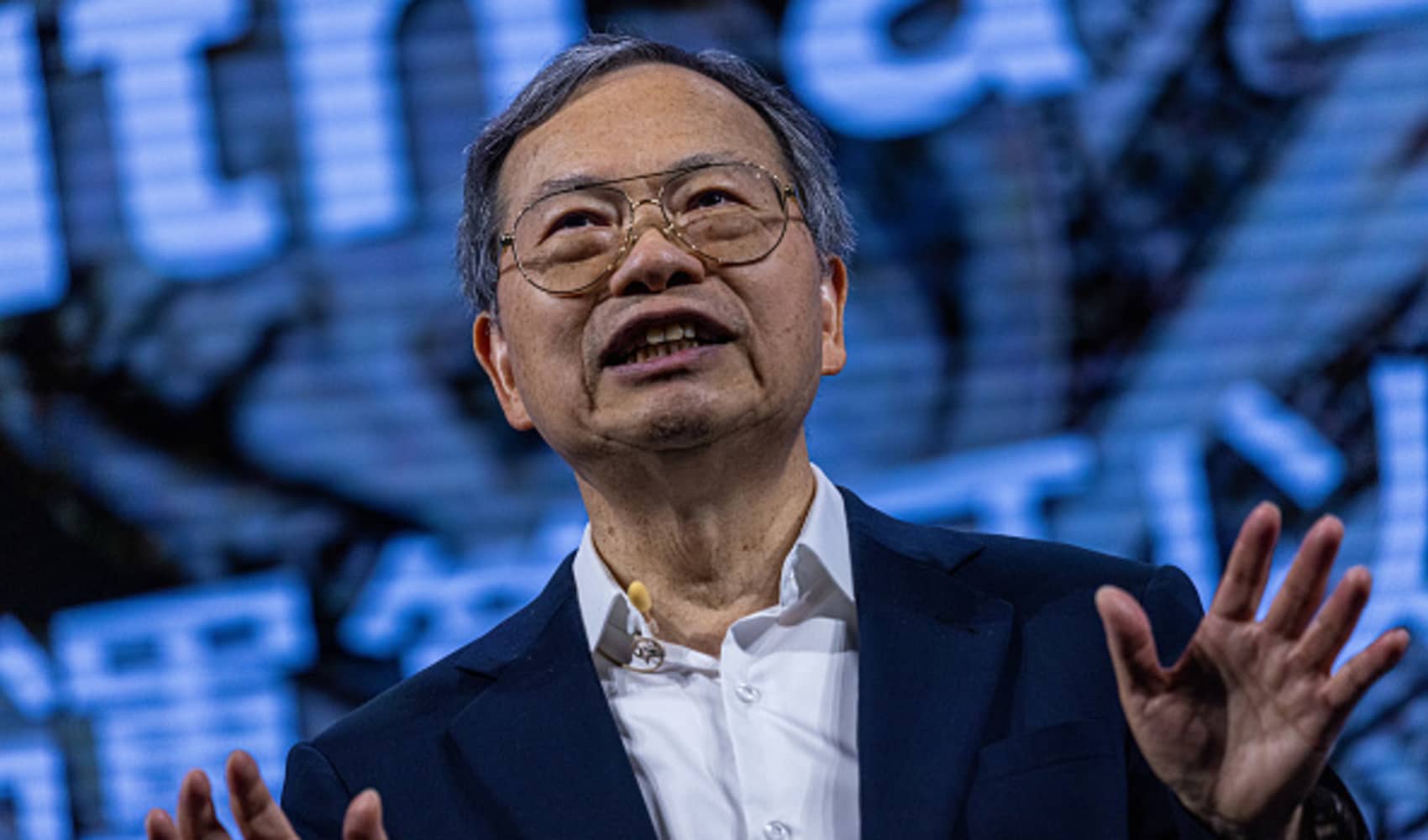

"That's a very effective strategy if you're in that bracket," said Andrew Gordon, a tax attorney, certified public accountant and president of Gordon Law Group.

The income limits for 0% capital gains may be higher than you expect, Gordon said.

For 2024, you qualify for the 0% rate with taxable income of $47,025 or less for single filers and $94,050 or less for married couples filing jointly. The brackets are higher for 2025.

You calculate taxable income by subtracting the greater of the standard or itemized deductions from your adjusted gross income. Your taxable income would include profits from a crypto sale.

For example, if a married couple earns $125,000 together in 2024, their taxable income may fall below $94,050 after they subtract the $29,200 standard deduction for married couples filing jointly.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter.

Money Report

Use the 0% bracket to reset your basis

You can also use the 0% capital gains bracket to reset your "basis," or the original purchase price of crypto, according to Matt Metras, an enrolled agent and owner of MDM Financial Services in Rochester, New York.

If you're in the 0% bracket, you can sell profitable crypto to harvest gains without triggering taxes. Then, you can repurchase the same asset to maintain your exposure.

However, experts suggest running a tax projection to see how increased income could affect your situation, such as phaseouts for tax breaks.

The price of bitcoin was hovering around $90,000, up more than 100% year to date, as of the afternoon on Nov. 18. The value briefly hit a record of $93,000 last week in a postelection rally.

It's obviously hard to predict future price increases. However, some investors expect a boost under President-elect Donald Trump, who promised pro-crypto policies on the campaign trail.