- Union Pacific and its CEO Lance Fritz are the subject of a Surface Transportation Board hearing this week, and the Board said that so far the railroad has "failed" to provide details on its use of 1,000 embargoes in 2022.

- STB is scrutinizing railroad staffing and service levels as part of its freight rail regulation.

- Union membership data reviewed by CNBC tells a different story than hiring information provided by railroads to the STB.

The strike was averted, but tensions between unions and class I freight railroads continue to run high.

Union Pacific's use of embargoes, a freight railroad practice in which trade is stopped in order to clear up congestion is at the center of a two-day hearing at the Surface Transportation Board in Washington, D.C., that started Tuesday. Also under scrutiny: the railroad's staffing data, including new hiring and retention of existing employees, which union officials at the hearing say doesn't present the full picture of declining employment in the sector.

Union Pacific CEO Lance Fritz and top UP executives are appearing before the STB to explain the company's actions which, to date, the federal agency that overseas freight transportation has deemed unsatisfactory. In a scathing letter sent to Fritz ahead of the hearing, STB chairman Martin J. Oberman said a recent PowerPoint from Union Pacific "failed to provide any detail" in response to an order from the STB to explain a "dramatic increase in embargoes since 2017," including whether UP has maintained sufficient resources during that time period,.

"It was expected that UP would have produced documents relating to the inception and continuation of the practice of more frequent use of embargoes, as well as the rest of the topics delineated by the Board. However, the PowerPoint presentation is silent on most of the topics listed in the November 22 order," Oberman wrote. "Unfortunately, UP's failure to fully respond to the order has hindered the Board in its efforts to understand this increase in the use of embargoes, and their causes and impacts."

In 2017, UP used five embargos as a way to manage restricted movements of rail-bound containers to alleviate congestion. In 2022, the railroad has had more than 1,000 to date, according to the STB.

Money Report

"This is a business model that serves the corporations, the railroad corporations, and not the customers," said Tony Cardwell, president of the Brotherhood of Maintenance of Way Employees (BMWED), a major rail union. "So it's there's an alarming trend out here that should be taken note of the supply chain is going to continue to suffer with the operating systems in place."

Supply chain, rail staffing and freight service levels

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter.

The STB is interested in how UP's staffing and service levels have impacted the supply chain and if the lack of labor is part of the reason behind the embargo. The board has also said it has "received numerous reports that shippers are suffering supply chain problems as a result of Union Pacific (UP) embargoes that are hampering their operations."

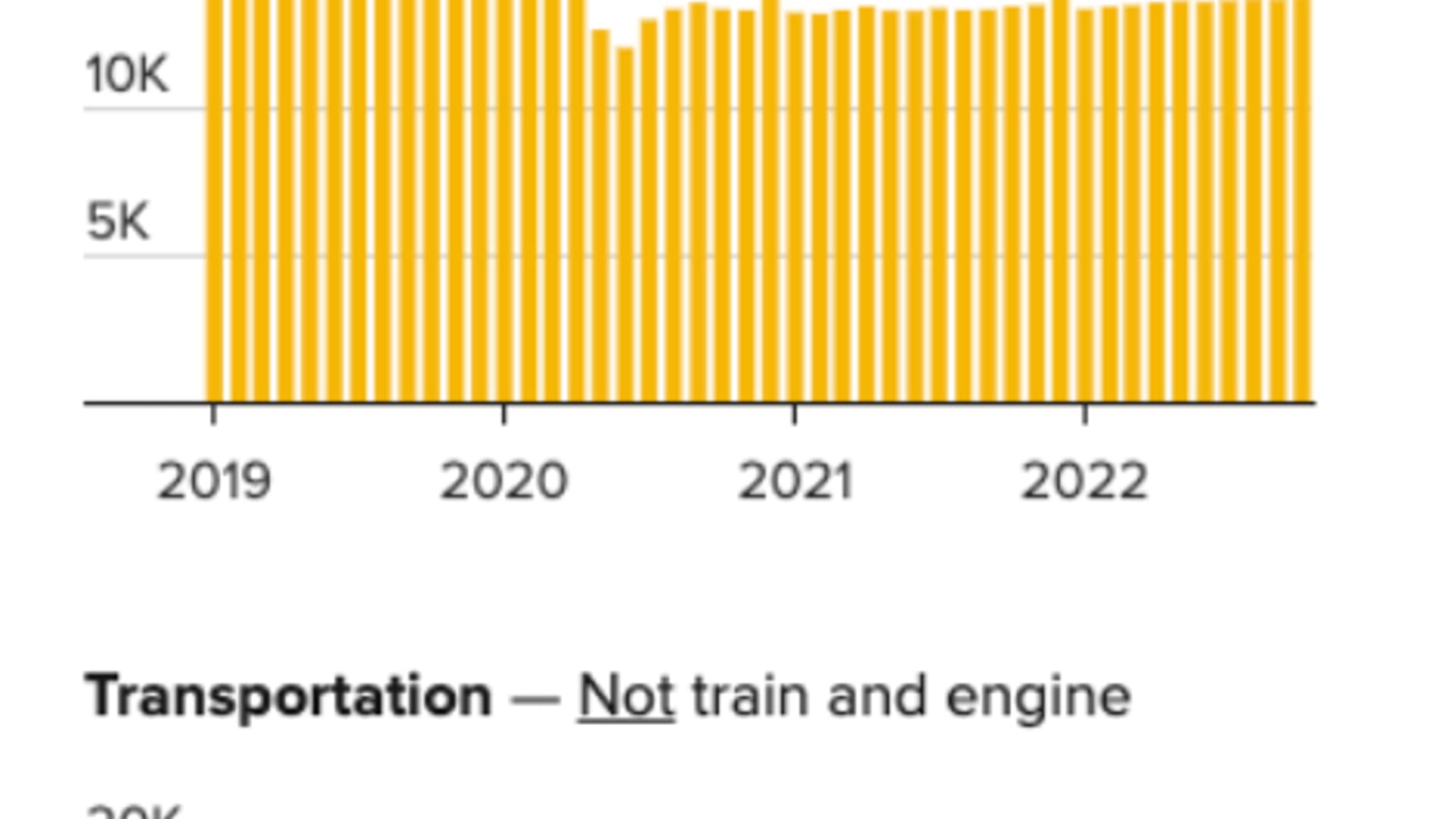

Each month, the railroads file their labor data with the STB. That information is then compiled into a running STB document. The STB labor data is broken out into six categories where there are over 89 distinct job titles that fall under those job families.

A CNBC review of the STB Union Pacific labor data starting January 2019 through October details the history of labor attrition, a timeframe that includes the combination of the deployment of the company's precision railroading strategy called, Unified Plan 2020, which was launched in October 2018 and rolled out in phases across the entire Union Pacific rail network. The impact of the Covid pandemic can also be seen in the drop in labor.

According to a Union Pacific spokesperson, total craft hiring was 27,753 in October 2022 compared to 32,315 in October 2019.

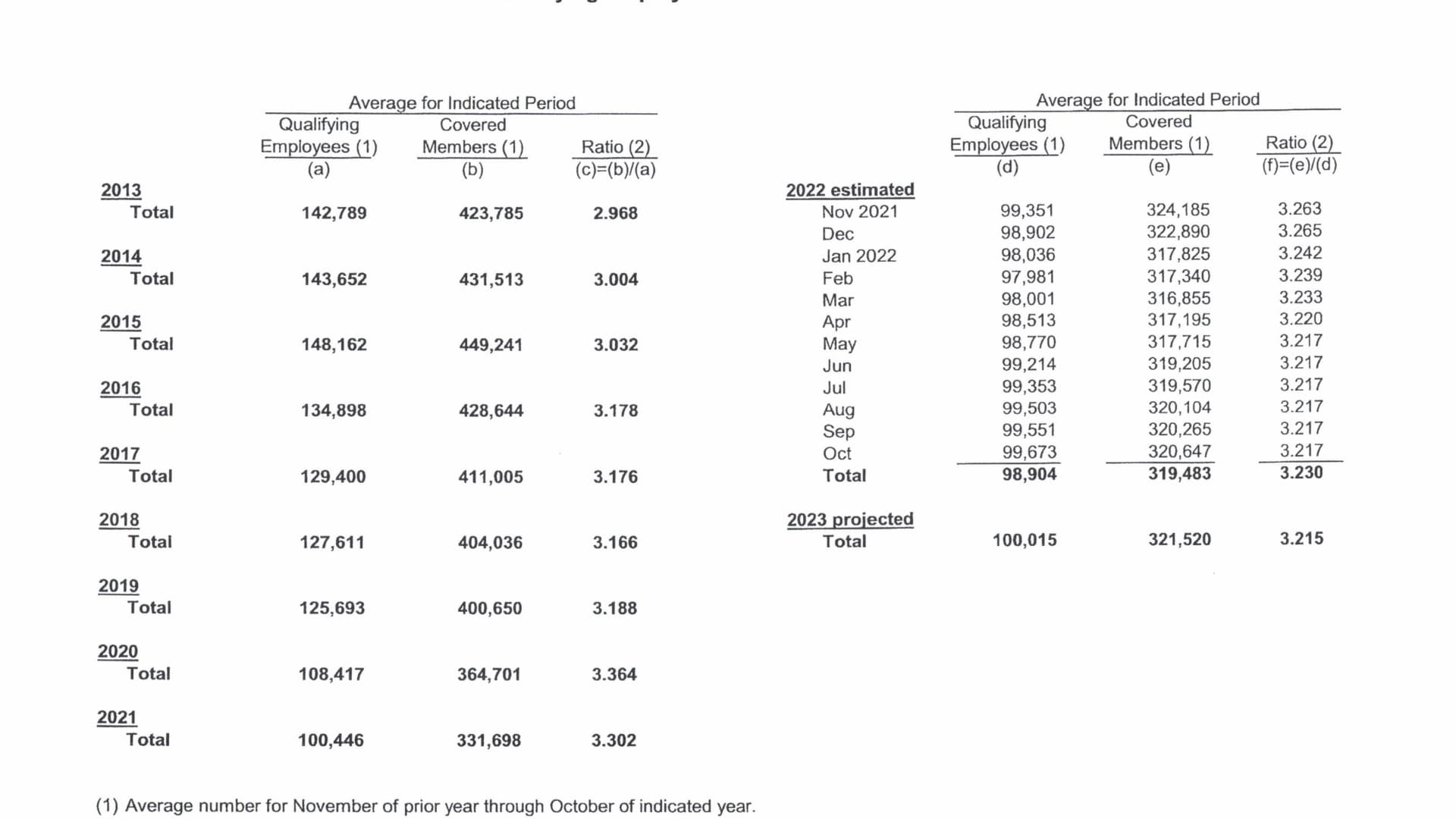

Data presented by Richard Edelman, one of the attorneys representing the rail unions, shows a disparity between labor membership numbers and hiring data given by the railroad carriers to the STB. In Edelman's 38-page filing, which was reviewed by CNBC, railroad labor data was broken down by each union to show the number of union members from October 2021 through September 2022.

Appearing before the STB on Tuesday, Edelman challenged Union Pacific and other class I rail employment levels by comparing their filings with union rolls. The board is expected to question Union Pacific executives on the disparity between rail and union labor numbers during the hearing.

Also included in Edelman's presentation, a United Healthcare report showing the number of railroad union policyholders and eligible policyholders.

The union data shows that the class I freight rails "may be hiring, but they are not retaining existing workers so there is no net gain," Edelman told CNBC ahead of the hearing. "Instead, they are lengthening trains to sizes that exceed infrastructure capacity which is adding to the congestion, instead of adding workers to improve the service."

Union membership data shows employment on all of the Class I rails, including Union Pacific, is down from just before the start of the pandemic and even down between October 2021 and October 2022. Year over year, union data shows BLET down 1,443; SMART TD is down by 92; BMWED is down 169; IAMAW is down 162. The National Conference of Firemen and Oilers laborers is up 81 members, while the Brotherhood of Railroad Signalmen has seen an additional 12 signalmen. "These numbers do not reflect the story being told by the railroad carriers that they are increasing their workforces," Edelman said.

An STB spokesman told CNBC that the railroads are under order to report accurately or face significant penalties or other regulatory action.

Recent railroad hiring

CNBC reached out to the major freight railroads about their hiring practices and retaining of talent, including CSX, Norfolk Southern, and BNSF, a subsidiary of Berkshire Hathaway.

CSX pointed to its third quarter earnings' count of active train & engine employees, those that are in training and conductor promotions.

The active count — which only includes employees available for work (e.g., not in training or out sick) — rose from 6,441 in Q3 2021 to 6,759 in Q3 this year.

"We currently sit in the mid-6,900s," said Cindy Schild, CSX spokeswoman.

She pushed back against contentions in the unions' documents, saying they are "without merit" in regard to CSX, and that data submitted by the railroad to STB is in accordance with what is specifically requested by the regulator.

Its interim update to STB specifically outlined six-month targets that were dependent on commensurate improvement in active T&E headcount over the same period, and described aggressive hiring and retention efforts CSX was undertaking to ensure a healthy pipeline of conductors.

"We have been pursuing every reasonable option to increase train-and-engine (T&E) employee hiring and retention to return our service levels back to the record levels we experienced prior to the pandemic. And, our recruiting initiatives have been producing positive results," Schild said.

BNSF told CNBC the railroad does not break down the numbers mid-year, but shared that in 2022, BNSF has hired 1,800 train crew personnel and 1,200 new employees on its engineering, mechanical, and dispatcher teams.

"These hires kept us ahead of attrition and we are at nearly 90% of our hiring plan for 2022," said Lena Kent, spokeswoman for BNSF Railway. "We are also already well underway on our hiring plan for 2023, and we will continue to hire in various locations across our network."

Norfolk Southern did not respond to a request for comment.

Union Pacific has attributed its use of embargoes to its geographic span, number of yards, customer facilities, and commodity mix. "Embargoes are one of the few tools, and last steps, to manage and meter customer-controlled railcar inventory levels, helping alleviate network congestion," a railroad spokesman recently told CNBC. The railroad also from time to time reduces Union Pacific-controlled railcar inventory, and can often work with customers to better align supply and demand without any embargo, the spokesperson said. "However, in some cases for a small percentage of customers, we create embargoes that allow Union Pacific to fairly serve everyone," the spokesperson said.

Jeremy Ferguson, president of SMART-TD, recently told CNBC he expects the real reasons behind UP's embargoes to come out in the hearings.

"I know that the end result is going to be once again precision scheduled railroading and the operating ratios for the quarter trying to achieve better results every chance that you get," Ferguson said. "When Marty [STB chairman Oberman] gets into this, I'm sure he's going to say that they do not have adequate staffing levels, contrary to what they have reported that they've been trying to do. They [Union Pacific] haven't kept up with the rate of attrition. And it's going to show when these facts come out."