- Inflation has eroded household budgets for well over a year, but the pain has not been shared equally.

- By most measures, low-income households have been hardest hit.

- However, only Americans in the middle class saw their real wages decline over this time.

Stubborn inflation has driven households near the breaking point, but the pain of high prices has not been shared equally.

By most measures, low-income households have been hardest hit, experts say. The lowest-paid workers spend more of their income on necessities such as food, rent and gas, categories that also experienced higher-than-average inflation spikes.

"The bottom line is unexpected inflation has done real damage to the public, but some people face a higher cost," said Laurence Kotlikoff, a professor of economics at Boston University.

Low-income families have a higher annual inflation rate

"The rich don't even know what gas prices are," said Tomas Philipson, former chair of the White House Council of Economic Advisers.

Money Report

Because higher-income households spend relatively more on services, which notched smaller price increases compared with goods, they came out ahead.

Their inflation rate is roughly 6%, compared with 7% for lower-income households who spend a bigger share of income on food, energy and shelter, according to an analysis by researchers at the University of Pennsylvania's Wharton School.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly> Chicago Catch-Up newsletter.

More from Personal Finance:

Credit card debt nears $1 trillion

How to get started with investing, budgeting

How much emergency savings you really need

Lower-income households also have fewer ways to reduce or change their spending habits and less in savings or investment accounts to fall back on, noted Brian Albrecht, chief economist at the International Center for Law and Economics.

"Inflation makes it hard to make decisions and think about the future, particularly for those with the fewest resources," Albrecht said.

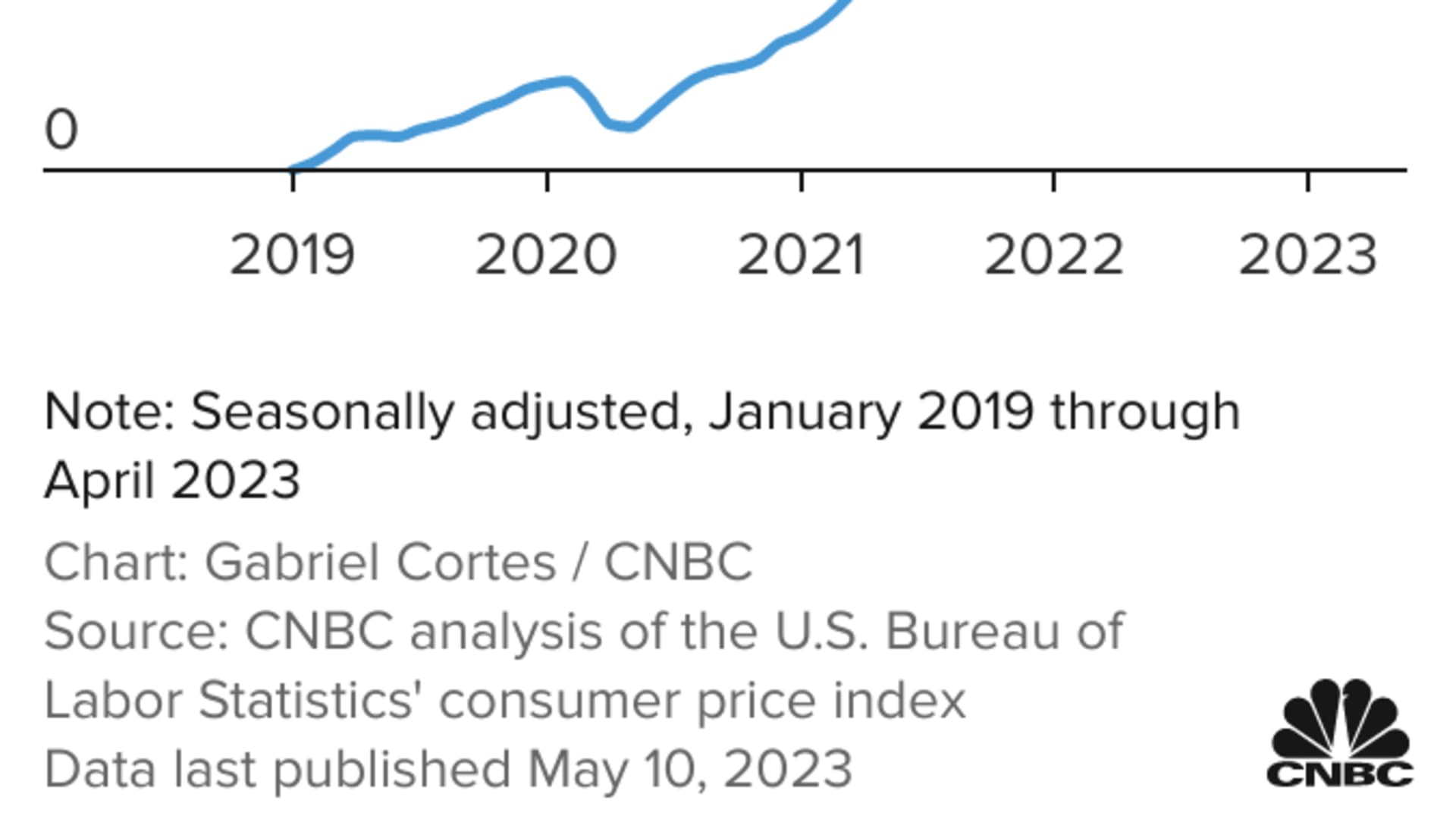

Middle-income households see slower wage growth

By other measures, Americans in the middle class are getting especially squeezed.

For them, prices increased faster than their income, according to a report by the Congressional Budget Office, while households in the lowest and highest income groups saw their income grow faster than prices over the same time period.

Even though middle-class wage growth is high by historical standards, it isn't keeping up with the increased cost of living, which in April was up 4.9% from the prior year — making it harder to live the same lifestyle previous middle-class generations did.

"Real wages have declined and that's a concern for workers," Philipson said.

Economists' definitions of middle class vary. The Pew Research Center defines middle class as those earning between two-thirds and twice the median American household income, which was $70,784 in 2021, according to Census Bureau data. That means American households earning as little as $47,189 and up to $141,568 are technically included, although the median income is roughly $90,000.

And yet, within the middle class, households with incomes between $50,000 and $125,000 feel fairly confident about their current economic standing and still have financial buffers to draw on, the latest research from the Bank of America Institute found.

"Job stability has a lot to do with it," said Aron Levine, Bank of America's president of preferred banking.

Inflation weighs on most Americans

Aside from their employment status, even those with similar resources are facing different impacts of inflation depending on where they live, whether they have a mortgage or student loan, receive federal benefits or other factors, said Boston University's Kotlikoff.

But across the board, nearly all households have been slow to adjust their spending habits even as prices rose significantly, which has left them worse off financially, according to a recent "Making Ends Meet" report by the Consumer Financial Protection Bureau.

Instead, Americans are dipping into their savings to keep up their spending, with the personal savings rate of 4.1% representing a 0.4 percentage point drop from March.

At the same time, they are leaning on credit cards to bridge the gap, with balances now up almost 20% from a year ago.

Together, that leaves many Americans — regardless of their economic standing — financially vulnerable in the event of a downturn.