The October jobs report showed a cooling labor market in the U.S., with many sectors showing minimal or negative growth as the economy added a relatively meager 150,000 jobs overall.

A bright spot came in health care and social assistance, which added more than 77,000 jobs. Within that, ambulatory health care gained 32,000 jobs.

If private education was included in that category, as some economists choose to do, there would have been 89,000 jobs added in that group.

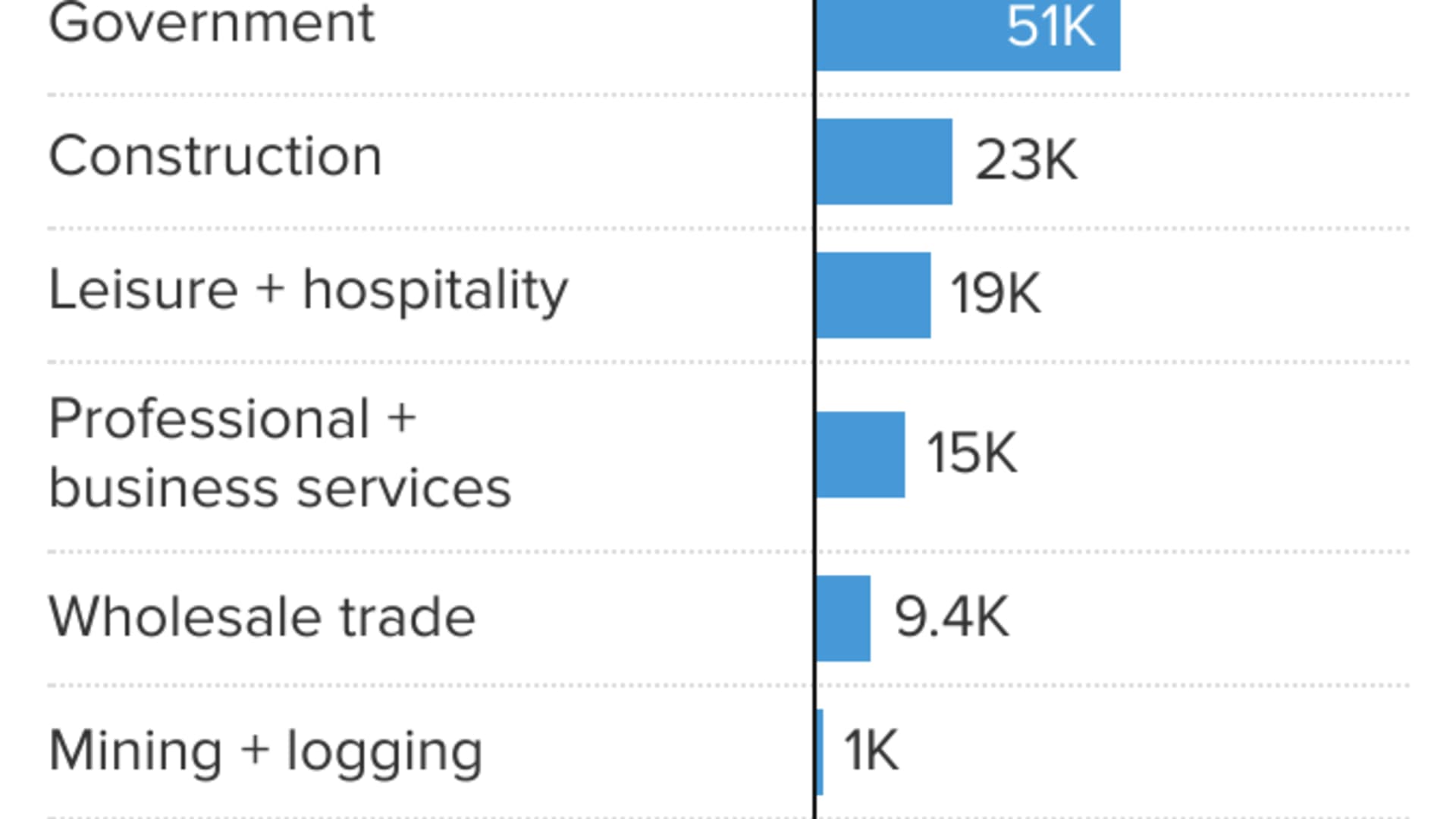

Government employment grew by 51,000, making it the second-strongest category in October. That sector has now returned to its pre-pandemic level, the U.S. Bureau of Labor Statistics said in the report.

"It's usually a bad thing when job growth is led by the public service, but in this case, it is long overdue. The private sector jobs recovery was much stronger and much faster than that of the public sector," said Julia Pollak, chief economist at ZipRecruiter.

Money Report

Other areas showed meager job growth and saw employment shrink. Mining and logging, utilities and retail trade combined to add just 2,500 jobs. Information shed 9,000 jobs, while transportation and warehousing lost more than 12,000 jobs.

"Many workers in trucking, for example, are finding very, very soft economic conditions. You lose one job and it is not easy to find another. The same is true in tech," Pollak said.

Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly Chicago Catch-Up newsletter.

Manufacturing was the weakest sector in October, dropping 35,000 jobs. The decline was due largely to strike activity, the BLS report said. That should improve in November now that the United Auto Workers union has now reached tentative agreements with the three major Detroit automakers.

Don't miss these stories from CNBC PRO:

- Bank of America's investment strategist says the S&P 500 correction could last until it hits this level

- A 'panic spike' is possible late October into November, says Bank of America's chart analyst

- The S&P 500 has entered a correction. Here's why Warren Buffett likely thinks that's good news

- Morgan Stanley auto analyst Jonas says investors are 'waking up' to idea that Ford, GM are not a way to play EV boom